Latest IRS Text Scam Claims Your Return Has Been Rejected

Home Help Center Latest IRS Text Scam Claims Your Return Has Been Rejected

- An Internal Revenue Service (IRS) text scam is circulating to get consumers’ personal information, which may put them at further risk of tax identity crimes.

- According to the Federal Trade Commission (FTC), imposter scams were the top reported fraud in 2020. The FTC had approximately 500,000 reports of the scam, leading to an estimated $1.2 billion in lost funds.

- People may receive text messages from their tax service but will never get a text message directly from the IRS. (People should still independently check with their filing service because scammers may also spoof tax filing entities.

- If anyone receives a text claiming to be from the IRS, they should ignore it, not click on any links or attachments, forward the text and originating phone number to the IRS at 202.552.1226 and then delete the text message.

- For more information on IRS text scams or if someone believes they are a victim of tax identity theft, they can visit www.idtheftcenter.org for resources or speak with an advisor toll-free by phone (888.400.5530) or live-chat.

IRS Text Scam Pops Up on First Day to File

February 12, 2021, is the first day for people to file their 2020 tax returns, and many consumers may receive an email or notification from their tax service that it is time to file. Scammers are trying to take advantage by posing as IRS agents to exploit tax filers.

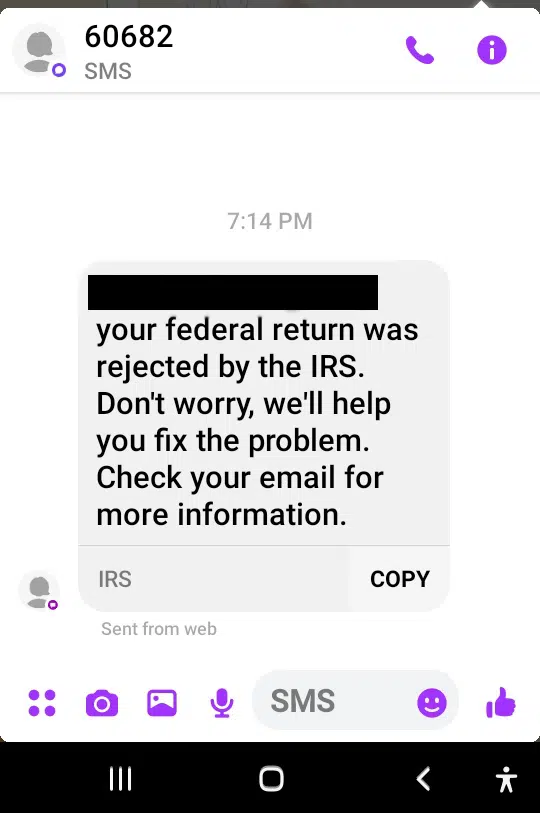

The Identity Theft Resource Center (ITRC) has received reports of a new Internal Revenue Service (IRS) text scam that claims “your federal tax return was rejected.” The IRS text scam is designed to get consumers’ personal information, which puts people at additional risk of tax identity theft. Here’s an example of the IRS text scam sent to the ITRC:

Government Imposter Scams Continue to Spread

The IRS text scam is not a new tactic for scammers. Government imposter scams were among the top frauds in 2020 reported by the Federal Trade Commission (FTC). The FTC says that they received nearly 500,000 reports of imposter scams that cost people $1.2 billion, with a median loss of $850. Government and business imposter scams were among the top categories of COVID-19 and stimulus-related reports.

Cybercriminals Target Tax Season

Criminals know they can take advantage of tax season by posing as an IRS representative, especially with more Americans likely to receive a Form 1099-G because their state employment office is providing documentation for receipt of unemployment benefits. However, many of those taxpayers may be victims of unemployment benefits fraud because identity thieves received benefits in their name.

What You Should Do

The IRS will not text anyone about their tax return. People may receive a text from their tax filer, but never from the IRS. (People should still independently check with their filing service because scammers may also spoof tax filing entities.)

If anyone gets a text message claiming to be the IRS, they should do the following:

- Do not respond, open any attachments or click on any links. An attachment or a link could contain a malicious code that has the ability to infect someone’s device.

- The IRS asks people to forward the IRS text scam and the originating phone number as-is to 202.552.1226.

- After forwarding the information to the IRS, the original text message should be deleted.

It is also a good idea to never respond to any unsolicited messages. Instead, consumers should reach out directly to the company or person the message claims to be from to verify the message’s validity. People should also refrain from providing their personal information unless it is necessary or with a trusted organization.

Contact the ITRC

Anyone who believes they are the victim of an IRS text scam, tax identity theft, or wants to learn more can visit the ITRC website for additional resources. They can also contact an advisor toll-free by phone (888.400.5530) or by live-chat. All people have to do is visit www.idtheftcenter.org to get started.

How much information are you putting out there? It’s probably too much. To help you stop sharing Too Much Information, sign up for the In the Loop.

Get ID Theft News

Stay informed with alerts, newsletters, and notifications from the Identity Theft Resource Center